Today’s write-up is about a special Swedish company that has put itself in an interesting position to increase earnings significantly over the next couple of years. Let’s dive in!

Executive summary

- Humble Group AB is a collection of acquired businesses related to sustainable snack brands, sport nutrition, and oral health products accompanied by manufacturers of these products and/or ingredients, and a distribution network.

- Through piling debt and declining margins, investors aren’t so sure about the company’s survival. However, as I will show in this write-up these concerns are unlikely to withhold the company from surviving and experiencing a significant increase in earnings over the next couple of years.

- Whereas management may not have made the best decisions regarding stock issuance and taking on debt to do acquisitions, after speaking and observing the CEO I believe he’s capable and willing to create shareholder value.

- Since the company is likely to experience significant margin expansion and a big reduction in interest expenses. I believe the company is valued at a forward 8.2x EV/FCF ’25 while a 13-15x would be more appropriate. This would result in a 26-35% CAGR from today’s prices.

Early Innings

In 2009, Bayn Europe was founded in Sweden as a response to the market’s demand for natural and healthy sugar reduction solutions. Starting out, the company focused on providing natural alternatives to sugar, mainly leveraging the sweetening power of Stevia – a sugar substitute made from leaves of the Stevia plant. Their goal was not just to offer a sugar alternative, but to ensure that the taste, texture, and overall sensory profile of sugar-reduced products remained uncompromised.

At the beginning of 2020, Bayn changed course to challenge conventional fast-moving consumer goods (FMCG) companies such as Unilever, Coca Cola, and Mondelez, and focus on products that are good for you and good for our planet. Some of the acquisitions include Pändy, The Humble Co., and Tweek Sweets. In 2021, Bayn Group changed its name to The Humble Group since the need for an updated business profile emerged.

Fast forward to today, The Humble Group has acquired 39 businesses since 2021. These companies are divided into four different segments: future snacking, quality nutrition, sustainable care and Nordic distribution.

Future Snacking

As the name suggests, under future snacking we can find candy and chocolate snack brands with the motto of being more healthy and sustainable without compromising taste. For example, less sugar, vitamin-enriched, palm-oil free, vegan, climate-friendlier packaging, and lower calories. Brands include Pändy, Tweek, True Gum, and more.

I have tried several brands myself and I have to say that most snacks are really tasty. On the other hand, it’s a bit more expensive on a gram for gram bases than the things I can find in my grocery store – the difference could be explained by that I live in the Netherlands and our cost of living is lower, but also the sizes of the packages are smaller of Humble’s brands – and don’t taste better than our everyday snacks per se, but in my eyes, it’s impossible create the most delicious snack while also being healthier than the alternatives, so that’s the consideration you need to make. Personally, I avoided snacking often because of health considerations. With the introduction of these healthier snacks I may start exploring whether some of these brands fit in my diet.

Besides these brands, the Group possess several manufacturing businesses that manufacture these snacks and some ingredients.

This segment generated 733 MSEK in 2022 (+182% vs 2021), which is 15% of the Group’s revenue and is on track to do 1 BSEK in 2023 (+36% vs 2022). Operating income amounted 85 MSEK which constitutes a 12% margin (2% in 2021), representing 28% of the Group’s operating profit.

Quality Nutrition

The Quality Nutrition segment comprises both brands and manufacturers of sports nutrition supplements and ingredients. Think of protein powder, protein bars, etc. This is sold either B2C through one of their brands or B2B, i.e. as white label. Some of the company’s brands include BodyScience, Golden Athlete, and Vitargo.

[The CEO, Simon, noted that when they bought BodyScience in …, the company was the third largest seller of sport nutrition in Australia while today, this business is the largest.]

Last year, this part of the business generated 965 MSEK revenue (+275% vs 2021), which is 20% of the Group’s revenue. The businesses achieved an operating margin of 6% (0% in 2021). This year they are on track to do 1.4 BSEK in revenue (+45% vs 2022).

Sustainable Care

Sustainable Care consists of a diverse range of brands, distributors and producers of personal care and household products. Their categories span skincare, hair care, body care, oral care as well as hygiene products, among others. Also the companies in this segment are trying to make their products more sustainable by exploring new materials and production methods to further reduce the environmental impact of the products.

The two most significant companies are The Humble Co., provide products for oral hygiene, and Naty, organic diapers, within this segment.

Overall, this group of 7+ companies generated 1.8 BSEK (+266% vs 2021), which is 37% of total revenue, accompanied by an operating margin of 7% (-22% in 2021). These companies are on track to do 2 BSEK in revenue in 2023 (+11% vs 2022).

Nordic distribution

Lastly, we have Nordic distribution. The Nordic distribution segment encompasses a network of wholesalers and distributors located in the Nordic region to bring their “better-for-your” products to all sales channels efficiently. Moreover, the Nordic Distribution segment also provides value-adding services such as logistics and supply chain management for the Group.

This segment generated 1.3 BSEK (+ 170% vs 2021) for the Group and are on track to do 2.3 BSEK (+77% vs 2022) in 2023. The operating margin is notably lower than the rest of the business, currently at 2% (0% in 2021).

The Humble Way

Simply put, Humble Group acquires companies that fit into one of the four buckets mentioned above. They operate in a decentralized way to keep the leaders of these businesses and their cultures. This should prevent the company from having integration problems and fosters the unique branding and focus for these businesses. Of all the companies acquired, four CEOs have left of which three were known in advance.

The Group is able to grow these acquired businesses often quickly due to synergies within the business. For example, they can leverage the platforms that one of their other brands are using to distribute these products more widely.

Pändy is an interesting case study. In 2020, the Group bought the company for 89 MSEK when it was doing approximately 40MSEK in revenue and losing 10MSEK on those sales. Since then, the Group has been able to grow Pändy’s revenue by over 300% by simple adding service stores, grocery stores, and export as distribution channels. The brand now generated approximately 160 MSEK revenue in 2022 with ‘solid profitability’ according to management.

The reason why this is difficult for a brand to do on its own is scale. No grocery store is going to deal with hundreds of smaller brands individually. It would be too much of a hassle. Let’s not even talk about how expensive distribution can be for these small brands to get their relatively low quantities to the places they need to be. The Group overall is likely to benefit from increased efficiency in distribution and logistics as the brands continue to grow and more brands are added to the portfolio.

Another advantage that brands benefit from under Humble is lower cost of supplies. Since many brands have overlapping products, the Group is able to buy things in bulk such as packaging, ingredients, etc.

Other smaller advantages can include sharing of best practices, centralized G&A and legal stuff, a business intelligence platform that provides data and insight to the entrepreneurs, and in-house sales growth. With in-house sales growth, I mean that the manufacturers and distribution companies within the Humble portfolio can add some acquired brands to their customer list since they may already manufacture ingredients or products that are similar.

For example, Bayn Europe developed their own patented artificial sweetener called EUREBA that has replaced other sweeteners of the Group’s brands. EUREBA can be substituted for a 1:1 ratio with sugar, has no impact on taste, and almost zero calories according to the company.

What’s more to like?

If we take a look at management, we see that the current CEO is the founder of Pändy, owning ~1% of the Group. He seems like a really capable CEO and his shareholder letters are great. As I read them, I get a better understanding of the business, what they are doing, and what they plan on doing, but I also get the idea that he’s focused on the right things such as improving efficiency and the long term.

At the same time, his dad or uncle holds a position of nearly 3% through his investment firm. Furthermore, the current COO is the founder of the Humble Co., owning more than 6% of the business.

They seem to be pretty conscious about capital allocation. Most businesses are acquired at an EV/EBITDA multiple of 7-12x while there are some companies acquired 30x EBITDA or more. Two can be explained by a probable margin expansion but one stands especially out. That’s the Humble Co. which was acquired for 35x EBITDA while the company already had a 26% margin. However, this could still be a good investment if they have been able or are able to grow revenue quickly and increase margins further.

Furthermore, the company has noted that the cost of capital has significantly increased in 2022, which notably increased the company’s debt burden – more on that in a bit – and therefore, they decided to acquire a lot less businesses in 2023. Now they are saying they will only acquire businesses that they see fit in really well with the company strategically and where they can have a good idea about the synergies from which the acquisition can benefit. Also, they are now more focused on growing organically and increasing profitability.

The CEO himself thinks that the company’s manufacturing capabilities, primarily in terms of quality, is on another level. This is partly justified by the large demand the company has seen for manufacturing. For example, the Group’s largest candy manufacturer, Grahns Konfektyr, does constantly have to turn down requests. Another example is Bars Production, which has sold out the entire capacity for 2024.

What makes The Humble Group attractive now?

I believe that the company is set up to significantly increase profits over the coming years as the acquisition rate slows down and the focus shifts to increasing efficiency and raising margins.

Besides that, the company has a lot of opportunities to expand internationally with their current portfolio and additional acquisitions which they then grow through their synergy playbook. Currently 60% of revenue originates from Sweden and 15% from the UK, but the FCMG market in the UK, Germany, France, and the US are significantly bigger than in Sweden.

The Group generated 618m SEK EBITDA for the LTM Q3 2023 which is a 9.2% EBITDA margin. Subtracting 330m in interest expenses (more on that later), 93m purchase of intangible assets, 87m capex, we end up with 108m SEK FCF for the LTM.

For 2024, I expect the company to grow revenue by 15% and improve its EBITDA margin to 10.5%. Due to the restructuring of debt, the company’s interest expense could come down to ~185m SEK. Furthermore, I assume a small increase in purchase of intangible assets and capex. We end up with 460m SEK FCF. This translates into a forward EV/FCF multiple of 12.1x.

For 2025, I again expect revenue to grow by 15% and EBITDA margin to increase by 1%. In this case, the company would end up with a FCF number close to 680m SEK FCF. This translates into a forward EV/FCF multiple of 8.2x.

Bull, Base & Bear

In the slide below, we can see that a fair multiple for Humble would be closer to 15x NTM EV/EBITDA.

Let’s be more conservative and say that the group deserves a 15x EV/EBIT multiple in two years. In this case, the company’s stock will be worth 20 SEK in 2025 or a ~45% CAGR.

In case the company’s valuation will be closer to 10x, its stock will be worth 12 SEK in 2025 and would result in a 14% CAGR.

The company may experience a lot more difficulty in growing revenue and raising margins since they may struggle with international expansion. In that case, I assume no margin expansion for the company and 8% revenue growth to 2025. We would end up with a share price of 10 SEK or a 5% CAGR.

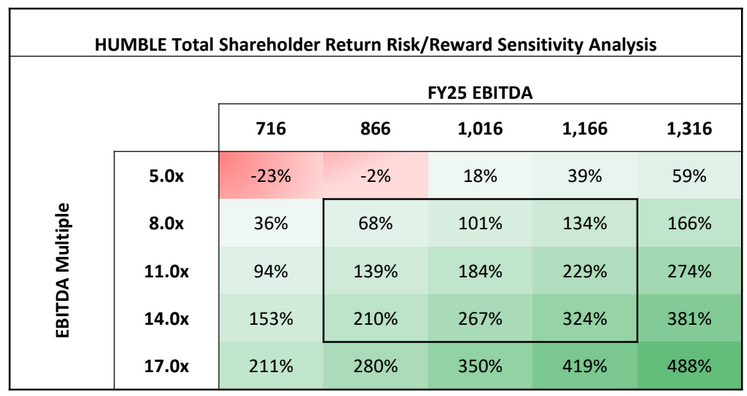

Alta Fox took a different valuation route. They focused on the company’s future EBITDA and possible EBITDA multiple.

Probable Peril Points

Just like every other company, this opportunity has its own risks.

- Competition

The large FMCG companies haven’t been focused as much on these smaller sustainable brands as The Humble Group has acquired. However, if the Group’s strategy seem to be a success, they may invite competition from the likes as Unilever, Mondelez, etc. or new entrants who want to emulate.

Additionally, if one of these large FMCG companies see that the Group’s strategy is working with their sustainable brands, these companies may introduce their own brands and just buy shelf space from retailers to sell their products. The Humble Group doesn’t have as much capital as these large conglomerates to buy shelf space themselves.

- Geopolitical risk

The CEO noted that lots of supplies they need for manufacturing are coming from China. If there’s any incident such as with Russia, the company may have a big problem.

- Buyer power of grocery chains

The Group is pretty dependent on retailers in general About 93% of revenue comes from traditional retail while 7% from online. Since shelf space for retailers is limited, there’s a lot of competition in getting shelf space. It is therefore inevitable that some brands and products will be removed from certain retailers’ shelf space. However, since the Group owns dozens of brands, this risk is mitigated a lot. If one brand does poorer than expected, another may do better than expected.

- Debt

Some of you may start sweating when you see the interest expenses of the company. Before restructuring, the company had about 330mSEK in interest expenses on 2,200mSEK debt with current interest rates. They reduced the debt to 1,850mSEK and probably also better rates, but don’t explicitly mention them. Therefore, I assume approximately 185mSEK in interest expenses going forward.

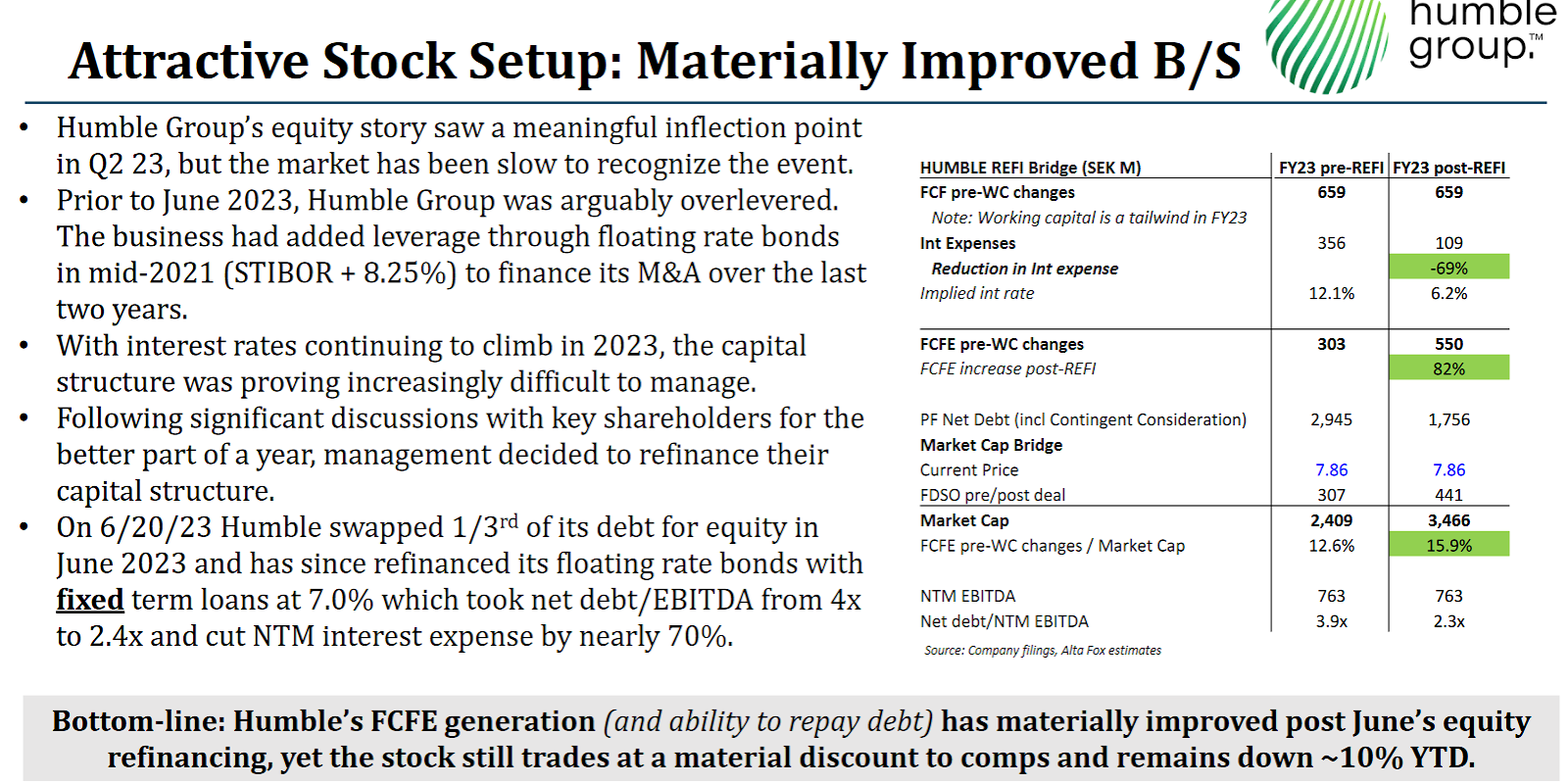

Alta Fox made a nice overview, but expects a significant reduction in the interest the company needs to pay.

That was today’s write-up. Thank you for reading, don’t hesitate to comment, and see you next time!

Leave a comment