Nowadays everyone knows them. The youngsters on the bikes delivering your dinner. But this wasn’t all that common. Most people didn’t even know about its existence before covid.

A lot has happened since covid. The industry was flooded by PE capital to conquer markets which led to large losses and there were many mergers and acquisitions with the hope to consolidate the industry.

But things seem to change. In 2023, PE funding dried up and industry players seem to redirect focus towards profitability instead of growth and capturing market share at all cost.

Let’s see if one of those industry players, Just Eat Takeaway, is poised to increase margins and whether this is an interesting investment opportunity or not.

Thanks for reading Noordermeer Capital! If you don’t want to miss any future posts, consider subscribing below.

0. Executive Summary

- Just Eat Takeaway owns multiple food delivery platforms such as Takeaway.com, Just Eat, Lieferando and Grubhub, operating in Europe, North America, Israel and Australia.

- After years of high growth and price wars, JET and its competitors started to focus on profitability instead of growth at all costs. As a result, Adjusted EBITDA/GTV margin has increased from -1.2% in 2021 to 1.2% in 2023, and is expected to expand even further over the next few years.

- JET trades at just 0.7x revenue which is significantly lower than DoorDash (6.0x), Uber (4.4x) and Delivery Hero (1.1x). This discount seems to be justified since JET has seen its total number of orders in all geographies decline while competitors have been able to increase their total number of orders.

- However, if JET is able to increase profitability in the Northern Europe and the UK and Ireland segments, grow modestly and sell off the North America and Southern Europe segments, it may be a double over the next five years.

1. Early Innings

While studying in the Netherlands in the late 1990s, Jitse Groen noticed how difficult, and sometimes even impossible, it was to order food online. This problem sparked the idea for Takeaway.com (Thuisbezorgd.nl in Dutch), which he launched in 2000.

He originally aimed for his company to deliver everything from groceries to clothes, but seeing the bigger demand for food delivery, he decided to focus on that first.

Here are the key events in the last decade:

- 2016: Takeaway.com went public, raising €328 million at a €993 million valuation and also sold their UK business to rival Just Eat in the same year.

- 2018: Delivery Hero, facing competition from Takeaway.com’s earlier acquisition of Lieferando.de, sold its German operations to Takeaway.com.

- 2019: Takeaway.com merged with Just Eat to form Just Eat Takeaway (JET), aiming to dominate the European market.

- 2020: In a bold move, JET acquired Grubhub in the US for a staggering €6.7 billion, more than double their market cap at the time.

After a period of consolidation, JET is one of the few large food delivery companies left in the world besides Uber Eats, Deliveroo, Delivery Hero and DoorDash.

2. Business Description

Just Eat Takeaway (JET) operates an online platform connecting customers with restaurants across Europe (including the UK and Ireland), North America (US and Canada), Australia, New Zealand, and Israel. On its platform, customers can browse restaurants, place orders, and choose delivery options. For restaurants delivering themselves, JET takes a commission of around 15% of the order value for facilitating the transaction. In other cases, JET handles delivery with its own employees or independent couriers, charging a higher commission of 30-35% of the overall order.

In recent years, the platform has expanded to include grocery stores, specialty retailers, convenience stores, liquor stores, and more, from which consumers are able to buy.

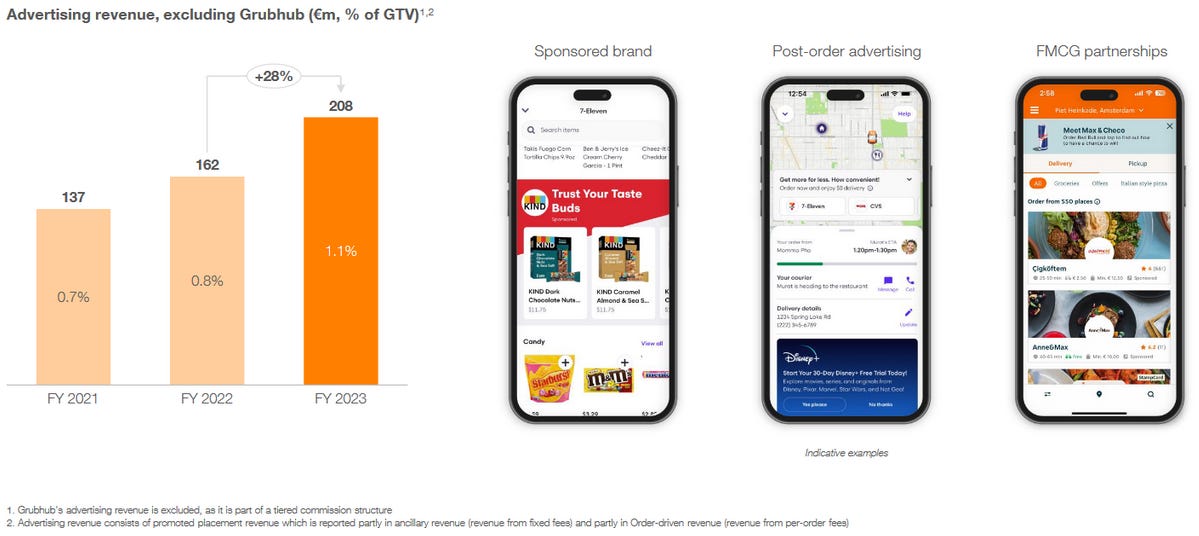

Another way JET earns money is by allowing restaurants or other stores to advertise on their platform. In this case, JET recommends a consumer to order at the advertising company, shows it on top of a search or shows post-order ads. Depending on the restaurant and location, JET could also charge delivery fees to consumers which tends to range from €0 to €5.

In 2023, JET had 84 million active customers and 699,000 local partners on the platform. They processed 891 million orders which facilitated €26.4 billion in GTV (Gross Transaction Value, the total value of all orders combined) and an average order value of €29.63 for 2023.

The company divides the business into four different geographical locations:

- North America (the US and Canada) – 38% of GTV and 1.3% adjusted EBITDA margin

- Northern Europe (the Netherlands, Belgium, Luxembourg, Denmark, Germany, Switzerland, Austria, Slovakia and Poland) – 29% of GTV and 4.8% adjusted EBITDA margin

- The UK and Ireland – 25% of GTV and 2.0% adjusted EBITDA margin

- Southern Europe and ANZ (France, Spain, Italy, Bulgaria, Australia, New Zealand and Israel) – 8% of GTV and -4.5% adjusted EBITDA margin

The company’s total addressable population in the markets in which they are operating is 706m. 12% of this number were active customers in 2023.

3. Industry and Competitors

After a wave of mergers and acquisitions in recent years, the food delivery market is left with just a handful of major players. These include big names like Just Eat Takeaway, Uber Eats, Delivery Hero, Deliveroo, and DoorDash, alongside smaller competitors like Bolt Food and Postmates.

Other competitors include on-demand delivery service companies such as Flink, Getir and Gorillas. Both restaurant chains delivering themselves such as Dominos and New York Pizza, and grocery deliverers such as Picnic and Instacart, can also be seen as competitors.

The Industry’s Nature

During the COVID boom, food delivery companies were all racing to become the biggest player in a market. This makes sense because, as you’ll see, the bigger a platform gets, the harder it is to knock them off the top spot. It takes a new company a lot of money and time to build a network as strong as the leader’s, which is why most companies were fighting to be the biggest, even if it meant losing money.

On top of the network effects, being the biggest player gives a company other advantages. They will have a denser delivery network than competitors, which means couriers spend less time waiting for orders. This also means shorter distances and faster deliveries, ultimately leading to lower delivery costs for customers.

Looking at how the industry is changing, we’ve seen companies pull out of markets where they can’t make a good profit in the long run. For example, JET shut down operations in Portugal, Norway, and Romania. Uber Eats left Italy and Israel in 2023, where JET is still hanging on.

To understand JET’s market share in different areas, let’s look at some data from Statista. It’s important to note that this information isn’t perfect – it’s based on surveys done in December 2023 with 500 to 1,500 people in each location. The question asked was, “Which food delivery brands did you use in the past year?” Here’s what they found:

- Just Eat Takeaway is still the leader in the UK but Deliveroo and Uber Eats seem to be on their heels.

- The company is at least miles ahead in Germany, Austria and the Netherlands.

- They are also taking the third and fourth spot in France and Spain.

Let’s take a deeper look into some of these geographies.

The UK and Ireland

The UK and Ireland are key markets for both JET and Deliveroo. JET processed €6.6 billion GTV there in 2023, while Deliveroo wasn’t far behind with €4.9 billion. Unfortunately, we don’t have sales figures for Uber Eats in this region.

Even though JET holds a bigger market share than Deliveroo, JET’s number of orders has been dropping. In 2022, their orders fell by 10%, and again by 6% in 2023. On the other hand, Deliveroo’s orders have grown, increasing by 7% in 2022 and 1% in 2023. Interestingly, Deliveroo also charges a higher fee per order compared to JET, with their take rate being about 10% higher. This indicates that Deliveroo has a larger % of orders delivered by their couriers than by restaurants themselves.

North America

Grubhub was the first major food delivery app in the US, starting back in 2004. But DoorDash has come on strong in recent years. In 2023, JET’s North American business (including SkipTheDishes in Canada) handled 281 million orders and had €10 billion GTV. DoorDash, which is mostly based in the US, did a whopping 2.1 billion orders and €67 billion GTV.

DoorDash isn’t just bigger than JET in North America, it’s growing much faster. The number of DoorDash orders jumped 25% in 2022 and another 24% in 2023. Meanwhile, JET’s North American orders fell by 13% in 2022 and another 14% in 2023.

Northern Europe

JET has been the top player in many European countries for food delivery. This is shown by their adjusted EBITDA margin, being one of the highest in the industry at 4.8%. However, JET seems to be stuck in these markets. The number of orders has been going down for the past two years, even though their GTV grew LSD and revenue grew HSD. This means JET’s take rate is going up – it went from 15% to 16.6% – one reason could be because they’re delivering more orders themselves instead of relying on restaurants to deliver.

It’s hard to compare JET to other companies since most of their big competitors left these markets. Uber is the only major competitor left in some areas.

Vertical Integration

Food delivery companies are finding it tough to make a profit. Raising prices could make people use the service less, and there’s a limit to how many deliveries a courier can do in an hour. While companies might be able to squeeze in more orders by grouping them together (like delivering two orders at once), there’s a limit. That’s why some companies, like Delivery Hero and DoorDash, are trying new things.

One idea is “Dmarts” or “DoorDash Marts” – basically warehouses stocked with groceries and convenience items that people can order through the delivery app. Delivery Hero says these Marts can be more profitable than regular deliveries, with a profit margin of 10% compared to 7% for regular deliveries.

DoorDash also tried “ghost kitchens” – kitchens that only cook food for delivery. However, they stopped focusing on this because it wasn’t as profitable as they’d hoped, and it’s hard to build a brand with a kitchen that customers can’t visit.

4. Business Quality

First of all, food delivery is a service that is here to stay. People may decide to order food more or less often during certain periods but there will always be people who want to order pizza or a burger. Just like people will continue to order all kinds of stuff online.

Furthermore, as we have seen with Uber and Facebook, network effects and scale advantages could be immensely profitable once being the largest in the market. However, in the food delivering industry it seems like there will be no clear winner anytime soon. This could always open the door for competitors to decide to take market share by lowering prices and/or spending on marketing, lowering profits in the end for all.

High profits might seem like a distant dream for food delivery companies, but the good news is they don’t need a ton of money to run. They mainly focus on keeping their app up-to-date, marketing, and paying delivery people. This means even JET, after accounting for goodwill and intangibles, has very little invested capital. This means that if the company is able to grow revenues organically from now on, it can earn a very attractive ROIC once being profitable.

5. Management

Jitse Groen, founder of Takeaway.com, is currently the CEO of the company. He has been the prime decision maker for the acquisitions of Just Eat and Grubhub. Currently, he still owns 7.2% of the shares outstanding.

The company’s current CFO is Brent Wissink. He joined the company as COO in 2011 and transitioned to CFO in 2014. Prior to this, he was CFO at NedStat – a fast growing technology company – and worked in venture capital at ABN AMRO and Mees Pierson.

Jörg Gerbig, founder of Lieferando.de, joined the company as COO in 2014 and has remained COO ever since. Prior to this, he worked on mergers and acquisitions at UBS Investment Bank.

Compensation

In 2023, the CEO, CFO, COO and CCO each received a base salary of approximately €750.000. Additional compensation they received are nearly €500.000 in short-term compensation and more than €300.000 in long-term compensation. In total, these four managers combined earned €6.5 million. This seems modest for a company doing €5 billion in revenue.

No targets for short-term and long-term compensation were presented.

Management’s Maneuvers

Management has been making significant progress over the past year. They’ve managed to cut delivery costs in the UK by 16% since 2021 by streamlining their delivery model and grouping orders. This has been accompanied by a major expansion in Northern Europe, where JET now reaches nearly all (95%) of the population. Additionally, they’ve achieved a 36% reduction in customer service costs and overall operating expenses per order in 2023.

These improvements show management’s commitment and capability to decrease costs and move towards profitability.

In 2020, management decided it’s time to combine countries into groups. Instead of showing the data and performance of individual countries, we are now only able to see the data and performance of Northern Europe, Southern Europe and ANZ, North America and the UK and Ireland. They say that it will make it easier to analyze their business but seems more like a way to cover poor performance of individual countries.

On top of that, a year later management announced they would not present data on how orders are splitted between marketplace and logistics (couriers of JET delivering the orders). This announcement came at a time when logistics as a percentage over overall orders increased from 18% in 2019 to 44% in 2021. It’s now more difficult to see how profitability within geographies develop since marketplace has a low take rate but had an EBITDA per order of €1.9 in 2020 while logistics has a higher take rate but had an EBITDA per order of -€2.0 in 2020.

Two significant activities over the past few years were the merger with Just Eat and the acquisition of Grubhub. Both investments have shown to be less fantastic than hoped with Just Eat seeing orders stagnate while Grubhub loses many orders each of the past two years.

In 2022 and 2023, management itself realized this and as a result, took a total impairment of goodwill of $6 billion. Nearly double the company’s current market cap. That seems like one of the worst acquisitions ever.

Whereas I will not try to justify management for making these acquisitions, there’s a strong reason why these acquisitions were needed to stay competitive going forward.

Imagine Takeaway.com dominating the Netherlands, Belgium, Germany and Austria. They are doing well, having 5-7% Adjusted EBITDA margin for all of these markets and are fine with just competing in these markets and not in any others. But then there’s Uber Eats, DoorDash or other food delivery businesses that have been able to conquer larger markets such as the US, Canada, the UK and/or multiple countries in Europe, Asia or Latam, also achieving a 5-7% Adjusted EBITDA margin in the end.

These companies could then use their profits – which are in this case significantly higher than that of Takeaway.com because the markets in which they are operating are bigger – to expand their empire. And which markets are better to compete with than the small ones where Takeaway is competing?

Since an Uber Eats or DoorDash may generate profits that are multiples higher than Takeaway, they will be able to withstand a price war in Takeaway’s markets much longer than Takeaway.

Therefore, Takeaway needs to expand their operations and what’s better than to start at zero in a market with network effects and scale advantages? Buying an established player.

6. Growth Opportunities

Active customers tend to order in the range of 3-3.5 times a month with JET while it’s 4.6 for Delivery Hero. Delivery Hero notes that the consumers who are customers with the company for 6-8 years tend to order between 6-6.5 times a month compared to 2.6-4.1 for customers that are 1-3 years with the company. Conclusively, as more consumers get accustomed to ordering food online, the more they tend to order over the years.

JET’s vision is to increase the number of orders from 2-3 orders per month to 2-3 orders per week – which can include breakfast, lunch, dinner, groceries or other necessities. This is very ambitious but should definitely not be seen as unachievable over the long term. Who would have thought 10 or 20 years ago that we would be buying as much stuff from Amazon and other online stores as we do today? How many packages are delivered at your house in a week? I bet for a certain part of the population that it’s close to 5 packages a week and for most at least once a week.

Similar to online shopping, younger people use food delivery services more frequently. As these younger generations age, it’s likely they’ll continue ordering food online at least a few times a month.

One way competitors of JET are trying to increase the number of orders per customer and increase customer loyalty is by providing subscriptions which could always eliminate the delivery fee, provide discounts on certain restaurants and more. Management has said that they will be rolling out subscriptions for Northern Europe in the first half of 2024.

Besides increasing the number of orders a customer makes in a month or week, another lever the company could pull is increasing the efficiency of the food delivering system. One strategy that most food delivery companies have been trying out is pooling of orders. In this case, couriers pick up two orders and deliver them after each other without a trip back to a restaurant in between. Whereas this may improve the economics of food delivery companies, it could significantly degrade the quality of the orders and customers may have to wait longer.

AI should be able to help over here as well. It should help increase the efficiency of current food delivery systems, eventually decreasing delivery times and costs over time while increasing the quality such as keeping the food hot.

However, there is a limit to how many orders a courier can deliver in an hour. It’s estimated that the limit is about 2/3 orders in an hour. That will be one reason why we will not see software margins for this kind of business.

Other growth opportunities include advertising sales becoming a larger % of GMV which could help increase margins or possibly merging with competitors to increase their network effects and scale advantages significantly.

What seems to be a tougher quest is increasing the number of active customers. Customer acquisition costs are difficult to calculate since we had significant increases in active customers during covid while JET is now losing active customers in all segments. All current active customers are primarily the young people ordering food, now trying to convince the other, more stubborn population to order online. This could possibly require a lot of marketing spend.

Another thing that is important to mention is that JET has been struggling with growing the numbers of orders and number of active customers on its platforms for all its segments. This can be partly explained by entering a normalized environment since we saw rapid growth in customers and orders during covid. Also, ordering food online often comes with a 20-30% markup and also take into account that food prices have risen significantly over the past few years and, as a result, the value proposition of ordering food online isn’t as attractive anymore.

Another factor could be that JET is simply losing market share. As mentioned before, both DoorDash and Deliveroo grew their numbers of orders YoY while JET did not.

7. Financials

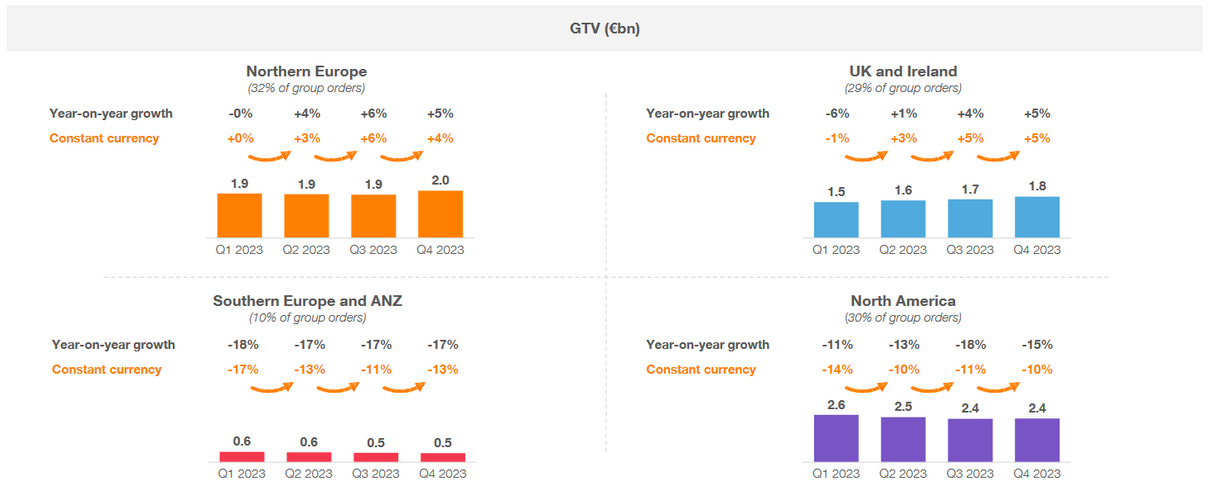

What shocked me was that JET’s Southern Europe & ANZ and North America divisions have seen >10% decrease in GTV YoY as can be seen in the figure below. Possible reasons could be due to price increases to move towards higher profitability which would lead to fewer orders, some countries were maybe still heavily impacted by covid in 2022 but not in 2023, and market share losses.

As I wrote before in the Industry and Competitors section, JET’s North America division has been losing a lot of market share to DoorDash (and maybe also Uber Eats). The same holds true for Southern Europe & ANZ. Delivery Hero has been growing GTV in these areas while JET sees steep declines.

All segments together saw the number of orders decline by 9.4% in 2022 and by 9.5% in 2023 after growing it by 33.1% in 2021 (this includes the acquisition of Grubhub in July 2021). Revenue for the company increased by 33.8% in 2021 which slowed down to just 4.3% in 2022 and a decline in 2023 of 7.1%.

There are positive developments though. The company has been trying to increase their profitability in all segments with decent progress as can be seen below. The North America division should actually have an adjusted EBITDA margin of ~2.3% due to NYC’s fee caps which depresses Grubhub’s adjusted EBITDA by €100m. These fee caps are expected to be terminated in 2024.

Another positive development is advertising revenue becoming a larger portion of GTV and revenue. Currently, it is only 4% of revenue but has the potential to be 15% of revenue and half of earnings. Delivery Hero targets advertising revenue to be 3-5% of GTV in the long run and notes it generates ~70% adjusted EBITDA margins for them.

Furthermore, the company has €2.1 billion dry powder and has to pay back €900m in loans in 2025 and €950m in 2027. In the meantime, the company has been using part of this cash pile to buy back shares. In 2023, they bought back about 9% of their outstanding shares.

8. Risks

Competition

As long as JET is not the biggest and most profitable food delivery company, it will run the risk of seeing increased competition from competitors. However, this risk is mitigated in markets where JET is the clear leader such as the Netherlands, Germany and Austria.

However, Uber also has the ride-sharing part of their business and the overall business is expected to generate $5-7 billion in EBIT annually. They may decide on starting a price war with any of the food delivery rivals and either let them sell out or let them run out of cash.

Not only that, JET has been losing share in the UK, North America and Southern Europe over the past two years – maybe also in Northern Europe – while also its competitors who did grow, are focusing on becoming profitable. There’s high uncertainty whether this will continue going forward but it speaks volumes.

Insourcing

Restaurant chains may decide to only deliver food if it’s ordered on their own platform. For example, McDonalds could only provide the food delivery option on their app. This way they would be able to increase their margins on food delivery or provide it more cheaply. This may decrease the number of orders the chain receives but could be minimized since McDonalds and other chains have obtained a very strong brand.

No Industry Growth

As mentioned before, JET has seen a decline in the number of orders placed over the past two years in all of its segments. Whereas competitors are growing in the UK and North America, the Northern Europe segment may see more difficulties to grow in market size than expected.

Labor

In the past, JET has had issues with regulators about employees and trade unions. For example, JET didn’t want to recognize a trade union in Israel even though more than 1/3 of the employees wanted a trade union and by law, JET should then work with them. Also, JET primarily employs students who earn close to minimum wage. Therefore, any increases in minimum wage could severely impact the company’s profitability.

Trustworthiness of Management

Since management stopped disclosing the performance of individual countries and how orders are splitted into marketplace or logistics, it makes it for analysts much more difficult to understand how the business is developing and making any accurate prediction of what the future might hold. What else may they be doing that is not in the best interest of shareholders?

9. Valuation

Since this business’s performance has been very volatile, it will be very difficult to value this company. Therefore, I’ll try to simplify things as much as possible.

Since Grubhub and the Southern Europe segment have been performing so poorly and there seems no light in the tunnel for growth, I assign no value to these parts of the business. The Southern Europe segment may even deserve a negative valuation since this segment is declining and has a negative 4.5% adjusted EBITDA margin.

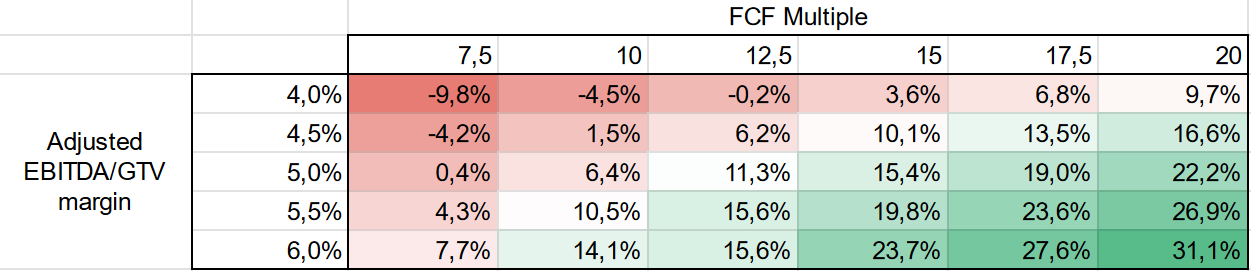

Let’s see how profitable JET would be if we eliminate both the North American and Southern European segments. The Northern Europe and the UK and Ireland segments generated a combined €2.6b in revenue and €500m adjusted EBITDA in 2023.

These two segments make up 55% of GTV. Therefore, I multiply the tax, share-based payments, leases and capex by 55% to get €176m in FCF which constitutes a 6.8% FCF margin. This implies an EV/FCF multiple of 19.6 as of 31 March 2024.

Let’s still only consider the UK and Ireland and Northern Europe segments and assume the following (to 2028):

- Total numbers of orders growth of 1% annually;

- 1% real growth in average order value (AOV) annually;

- a 2% inflation rate;

- 0.2% take rate increases annually;

- Adjusted EBITDA/Revenue margin increase from 28.7% to 31.0% for the Northern European segment;

- Adjusted EBITDA/Revenue margin increase from 10.3% to 25% for the UK and Ireland segment.

As a result, we get 4% CAGR for GTV and 5% CAGR for revenue for the next five years. Adjusted EBITDA/Revenue margin increases from 19.4% to 28.0% and Adjusted EBITDA/GTV margin increases from 3.5% to 5.3% over the same period.

If we then subtract share-based payments, leases, taxes and capex accordingly, we get €478m in FCF in five years. Applying a 15x FCF multiple would result in a double from today’s price or a 15% CAGR.

To be honest, I have very little idea how much JET is going to grow in these markets, that’s why I assumed just modest growth and decent margin expansion since margin expansion is something management has more control over.

In the table below, I present to you a sensitivity analysis. It would not surprise me if the company is able to get to 6.0% Adjusted EBITDA/GTV margin in five years since this threshold was already passed by JET in the Netherlands in 2020, when data on individual countries was still presented.

It may still not be very clear to you how this looks. Therefore, you may want to take a look at my model.

10. Conclusion

Just Eat Takeaway is currently operating in a competitive industry where network effects play a key role. The company has managed to find at least a few markets in Europe which it is able to dominate but has been unsuccessful in growing the number of orders in all of its geographies.

Management is actively working on improving efficiencies and making the company more profitable. Its current CEO and founder owns 7.2% of the company. However, management has taken actions in the past to cover poor performance of geographies.

If you believe the food delivery is poised to grow over the coming years and believe that JET will strengthen its current position, this could be an interesting investment opportunity (not investment advice).

Leave a comment